With more than a trillion dollars of dry powder waiting to be put to work, buyers are eager to identify and close new deals in order to put capital to work. But as valuations have risen and EBITDA multiples have flattened, it has become essential that funds adopt a structured plan for implementing operational improvements and value creation at their portfolio companies.

Under these conditions, platform roll-ups have become an important tool in building portfolio value. But a platform is more than a collection of companies in the same general business. Building a successful platform requires rigorous planning and diligence and careful selection of add-on acquisitions based on deliberate and structured diligence and post-merger integration plans.

Conversely, without careful integration planning and implementation, a platform is no more valuable that the collection of assets that was acquired.

The Investment Thesis

Planning a platform starts after formulating an investment thesis. The thesis generally determines that value can be created in some largely fragmented industry by combining one or more of its players. It’s important to remember that while the thesis is backed by industry research and knowledge, it is not a plan or even a strategy.

We are regularly put in the difficult position of repairing poorly planned platform investments.

The most important question to be answered is what is to be done with this asset once it is acquired. The idea that one can simply take a generalized thesis and buy a good company will certainly lead to failure. But careful strategy development and following the steps below will increase the chances of a positive outcome for a well running scalable platform play.

At Mainsheet Operating Partners, we are regularly put in the difficult position of repairing poorly planned platform investments. One of our recent engagements involved, among other things:

- A platform that had acquired four add-on sover an 18-month period

- A CEO in the process of retiring and a replacement who had never before served as CEO or executed an acquisition

- No integration work on the four add-ons because management was busy figuring out the business model and solving internal issues

- No formal post-merger integration plans or value creation plan for the platform.

This essay was written with the hope that careful planning can help an investment fund avoid the scenario above. So with that in mind, here are the 3 key steps to building a successful platform play:

- Start with a solid platform

- Define the acquisition strategy

- Execute due diligence that is specifically designed for platform add-ons

Step 1: Start with a Solid Platform

The first company in a platform needs to be the anchor company. The anchor must be solid enough to handle a series of add-on acquisitions. This does not mean that one needs to start with a company that is 100% ready. It does mean, however, that any add-on acquisitions should only be considered when the platform is ready and the acquisition strategy is prepared.

The management team must have the bandwidth and capability to focus on the roll-up rather than figuring out some other aspect of the anchor company’s business. A close look needs to be taken at the following areas to ensure that the platform has the proper attributes to serve as a platform’s anchor:

- Management team – The team should be industry experts who have executed acquisition integrations before and are motivated to do it again

- Solid Business Model – The anchor should be making money or cash flow and the business model should be solid and repeatable. It is critical that this company and its management team have already ‘figured it out’

- Technology – The anchor should have a unique technology or other special sauce that provides an edge in the market

- SOPs/ Infrastructure/ Systems – The anchor should be operating with systems, processes, and procedures that can easily translate to the add-on companies and help to make each add-on acquisition integrated and accretive as quickly as possible

The best anchor companies are well run and cash flow positive, with strong systems and SOPs, and/or special sauce such as proven proprietary tech or IP. If the chosen anchor company is missing any of the above attributes it is important to begin filling the holes before starting down the path of acquisitions and integrations. In other words, don’t start building the house until the foundation is set.

Step 2: Define the Acquisition Strategy

It may seem like the acquisition strategy should be developed before the anchor company is identified. But in most cases, it will be very difficult to acquire an anchor company that exactly matches a pre-defined investment strategy.

Therefore, an anchor is acquired that meets the needs of the overall investment thesis as well as having some of the attributes or capabilities listed above as criteria for a solid anchor company. Only then can the acquisition strategy be built around the characteristics of the anchor. For example, if the anchor has a ubiquitous geographical footprint and dominates with a very narrow product offering, the strategy might be to identify new product offerings to add to the geographic footprint. The strategy is obviously dependent on the attributes of the anchor company.

An industry map serves as the basis for creating a list of target acquisitions.

In order to define the acquisition strategy, start by defining the attributes that need to be added to the anchor to complete the investment thesis. Then, map out the industry by creating an inventory of competitors / potential acquisitions.

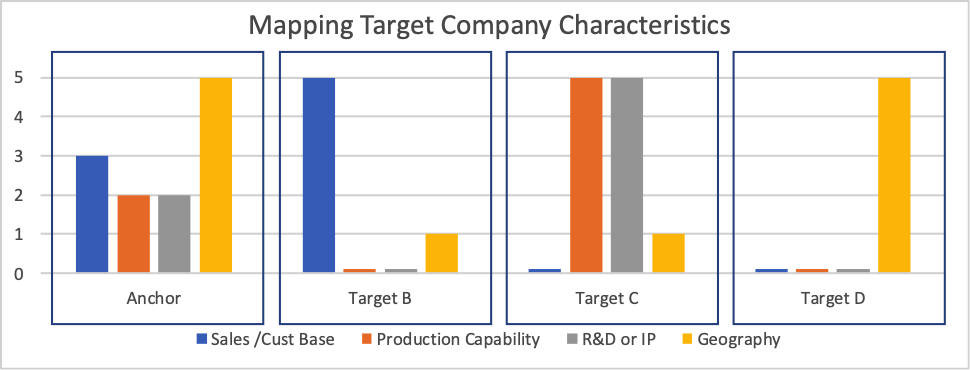

An industry map is essential to understanding the competitive dynamic and how the game will play out and, more important, it serves as the basis for creating a list of target acquisitions. A proper map of the characteristics of potential acquisition candidates should consider and / or include:

- Contributes an important attribute required to reach the platform goal

- Sales – Has coveted customer roster or other selling capability

- Production Capability – Has capabilities that enhance production

- R&D or IP – Has IP or R&D that create barriers and protect the future

- Geographical – Has a needed geographical footprint for selling or delivering

- Likelihood of success of closing a deal with this company and cost of closing a deal (some deals are not worth pursuing

- Ease of Integration – How well can the anchor management onboard the new acquisition?

The mapping of possible acquisition targets should then be ranked against the attributes that need to be added to the anchor to build the platform. After the industry map is complete, defining the acquisition strategy will be a matter of overlaying the capabilities of the potential acquisitions against the capabilities of the platform.

Each company will have dozens of both negative and positive attributes, and each attribute should be assigned a ranking of importance on the target list. The order of pursuit will be a balancing act of acquiring companies that move toward the final goal as quickly as possible compared to the financial wherewithal and management capabilities / bandwidth required to integrate the add on into the platform. Strenuous discipline is required to stay on course and not be opportunistic with ‘easy add-ons.’

Step 3: Execute Due Diligence for Fit

Once the targets are identified it’s time to start reviewing them in more detail. All aspects of the due diligence process need to look not only at the add-on target, but also at the anchor company and the other companies already added to the roll up.

Integration ease, accretive financial value, and adding characteristics that get the platform closer to the end-goal are all equally important considerations. Additionally, due diligence for platform add-ons must pay closer attention to competition.

Competitors may react as they see how the industry landscape is changing or as a result of the acquisitions being made. Be certain that a sleeping giant is not awakened before the platform is ready for battle. Essential attributes for platform plays include:

| Anchor Company | Add-on Companies |

|---|---|

|

|

The due diligence team needs to consider that the acquisition is going to be placed into another entity and will require integration. In addition to the due diligence one performs for a standalone company, the add-on must be evaluated for all the ways – good and bad – in which the acquisition will impact the platform.

The typical failure rate for a single M&A transaction is at least 60% and usually more like 75%.

When we execute operational due diligence for a standalone company, the value creation plan is created and validated as a part of the diligence process. But our operational due diligence for an add-on involves the creation of the post-merger integration plan and also impacts the anchor company value creation plan. The following maps out the operational due diligence for different acquisition situations.

| Standalone Company Due Diligence | Anchor Company of Roll-Up Due Diligence | Add-on Company for Rollup Due Diligence | |

|---|---|---|---|

| Important Diligence Areas |

|

|

|

| Outputs of Diligence |

|

|

|

Some of the key areas where due diligence is specific to platform adds-ons:

- Financial – How fast can the acquisition be accretive? How easily can changes be made that will make it even more accretive?

- Capabilities Mapping – Instead of looking at the ability of the target company’s standalone capabilities, one must review how the capabilities map to the existing capabilities and how easily the capabilities can be integrated into the platform. This includes everything from geographic coverage to technical capabilities and everything in between.

- Cultural integration – How will the culture of the add-on affect the add-on and the platform as a whole?

- Business Model Integration – How well do the business models align?

- SOPs and Technology – How easily can the systems and procedures of the platform be adopted by the add-on?

- Complementary Management Capabilities – The add-on’s management team does not need to be ready to quarterback the ball to the end zone, but there should be some value-added pickups for the platform in the management team.

- Anchor Company Management Bandwidth – How will this add-on impact management’s ability to execute on the plan?

- Garbage / Headaches – What garbage or headaches come with the acquisition and how will they impact the platform value creation plan?

The bottom line: Building platforms requires much more planning than does a single company acquisition. The typical failure rate for a single M&A transaction is at least 60% and usually more like 75%.

When building a platform, each acquisition’s potential failure rate can provide a compounding rate of failure because each add-on is impacting the platform as a whole. This almost guarantees that a poorly planned platform play will fail. But with a strong anchor company, a well-developed strategy, and careful due diligence, there is tremendous opportunity for value creation using a platform building strategy.

About MSOP: Mainsheet Operating Partners specializes in providing portfolio management teams with the expert strategic and tactical assistance necessary to create highly valuable businesses with outstanding exit options for their investors. Contact us at 201.721.8605 or visit us on the web at www.mainsheetop.com