High asset prices have placed enormous pressures on middle market private equity management teams to execute ‘the plan.’ While we previously focused on how an Operating Partner can help prevent the epidemic in CEO turnover plaguing many such operations, in this post we want to talk about an equally important component of the equation: identifying and building an effective Board of Directors.

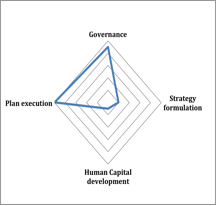

It goes without saying that the BoD is critical in ensuring investor returns. And while the nature of the BoD roles and where they should invest their time and energies are somewhat dependent on the circumstances of the deal and the nature of the value creation plan, there are four areas the BoD upon must focus on irrespective of the deal nature:

- Governance

- Plan Execution

- Strategy Formulation

- Human Capital Development

Each of these areas requires some time and attention to assure the prosperity of the firm.

However, at its most extreme (or worst), the BoD expends a disproportionate amount of effort on plan execution and governance. And while plan execution is clearly an important role, the focus on this issue to the exclusion of everything else can lead to a BoD that finds itself looking in the rear-view mirror.

Spreading the Wealth: The 4 Areas that Need BoD Attention

As a previous CEO of a privately owned business, it is frustrating to attend Board meetings where discussions on plan execution consume the majority of the meeting.

So let’s take a look at each of the tasks outlined and why we think they deserve BoD attention.

- Governance – Probably the key role of the BoD as it relates to reporting, compliance and stakeholder

management. However, there is the need for a carefully considered drawing (and maybe subsequent re-drawing) of the boundaries between governance and management in private investments. It may be that there are elements of executive decision making that the Board wants to specifically control in order to fully bring its assembled wisdom to bear. We think that going into a deal, the investors need to make a clear decision about the boundaries and ensure that the CEO understands and accepts these boundaries; early post-close is no time to be working this out!

management. However, there is the need for a carefully considered drawing (and maybe subsequent re-drawing) of the boundaries between governance and management in private investments. It may be that there are elements of executive decision making that the Board wants to specifically control in order to fully bring its assembled wisdom to bear. We think that going into a deal, the investors need to make a clear decision about the boundaries and ensure that the CEO understands and accepts these boundaries; early post-close is no time to be working this out! - Plan Execution – Reporting on the execution of the agreed value creation plan is, of course, a significant matter for the Board. But, to avoid the spectre of attempting to drive forward by looking in the rear view mirror, the Board needs to shape its agenda in order to focus not only on what’s been done but on recovery actions (if required) and the upcoming major actions required to deliver the plan; a more proactive and supporting agenda. Failure to execute seems to be one of the primary causes of early CEO exit. A Board that gets ahead of the problems inherent in any major value creation plan can do much to mitigate this risk.

- Human Capital Development – We know that major changes in an organization related to the pressures of value creation can and will stress key members of the leadership team. Making succession planning and an in-depth understanding of the performance and state of mind of the key players in the leadership team should be a focus of the Board and something that should be discussed outside board meetings as well as a standing agenda item.

- Strategy Formulation – It is often the case that the annual budget cycle and a ‘strategic discussion’ are conflated, with the budget approval process taking most of the oxygen out of the room. Somewhat related to the issue of Governance, there is a case for a much more significant involvement of the Board in strategy formulation and this should be a more frequent discussion. The idea that management presents a ‘fully baked’ strategy for approval by the Board may not be appropriate for many private investments.

While this is situation dependant, there is a way of looking at the composition and role of the BoD of smaller privately owned businesses, using a different lens that may lead to better outcomes.

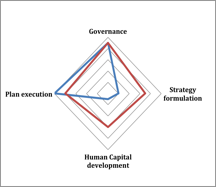

The profile in red (shown opposite) is obviously a simple abstract view of how the balance may need to change.

The idea is that the decision about the focus of the Board in these four dimensions is a proactive decision that forms an element of the investor ‘playbook.’

We think that this model poses two significant questions

- Who will sit on the Board and what roles will they play?

- How much time are members of the Board expected to devote to the company?

Expanding Role of the Board

There is a continuing trend on the Boards of public companies for Directors to spend increasing amounts of time on their board duties, especially in the area of strategy. It would seem to be clear that having an informed opinion about both strategy formulation and human capital development requires that Board Directors are much better informed about the company, its markets, its customers and its operations, all of which demand an increased investment of time between BoD meetings.

We think that the role of Chairman is a critical choice in delivering this playbook. The Chairman needs to be capable of driving a dynamic and forward-looking agenda, as well as orchestrating the relationships between the BoD and CEO in a way that legitimizes ‘tough’ discussions in a non-confrontational and open environment.

We have previously commented on the role of an effective Operating Partner and their relationship with the CEO; a role that demands both an intimate understanding of the business and a relationship based on trust with the CEO.

We think that the Operating Partner is an important component of this enhanced Board of Directors, but the other members need to be chosen for specific skills and perspectives and then built into a coherent whole. Decisions about Board membership based solely on participation in creating the deal may not cut it any more.